how to check tfsa contribution room

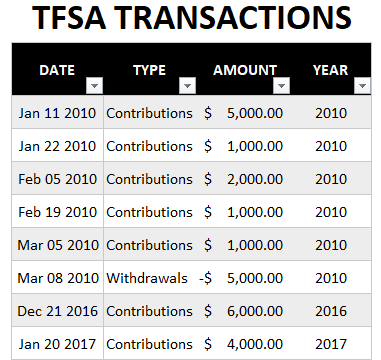

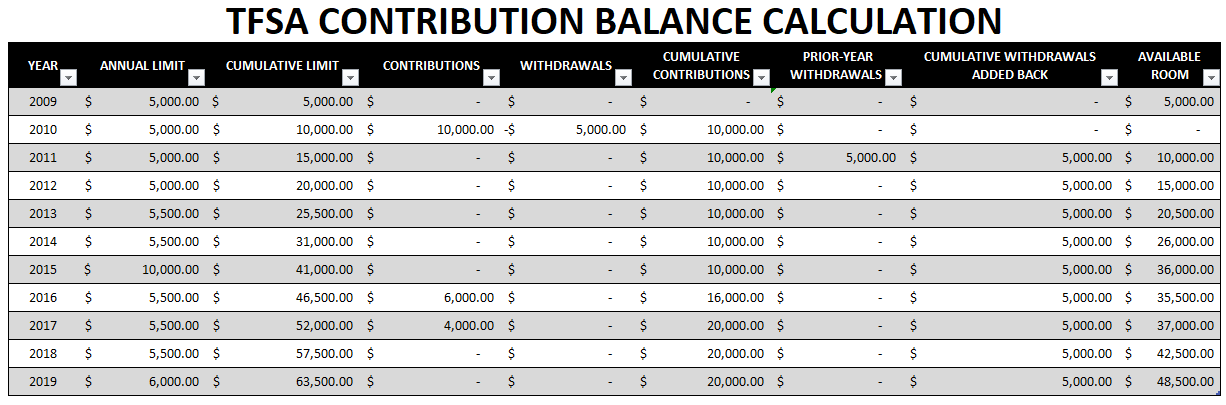

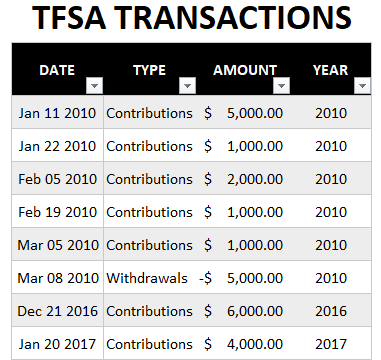

The Canada Revenue Agency CRA tracks your contribution room. Enter your current Contribution Room from the CRA in cell H5.

You Should Be Maxing Out Your Tfsa Forbes Wealth Blog

Enter every Contribution and Withdrawal in the table starting in the same year as the Contribution Room you entered from the CRA.

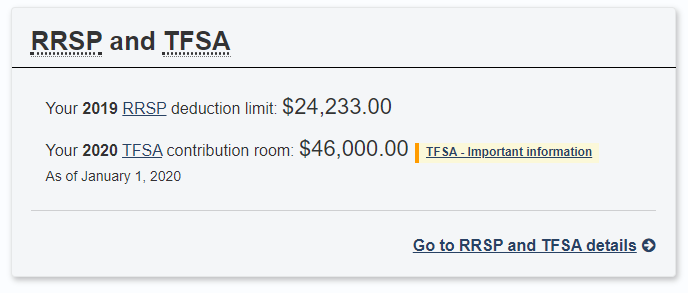

. Canada Revenue Agency tracks your contribution room. Get general information and find out the amount of registered retirement savings plan RRSP contributions you can deduct on your current-year returnand if it applies any unused contributions available for you to claimas well as your tax-free savings account TFSA contribution room as of January 1 of the current year. How to check your TFSA contribution room. Lastly 1 for room Double check.

Tax free means that you dont pay taxes on. If youre nervous about over-contributing to your TFSA just check your TFSA contribution room and dont deposit more than that. By the last day of February of the following year all institutions ie. You will accumulate TFSA contribution room for each year even if you do not file an income tax and benefit return or open a TFSA.

And since the inflation is at an 18-year high it may reflect in the TFSA contribution room for 2022 but until a definitive announcement is made we have to assume that the limit will follow the pattern and will be 6000. Any contributions or withdrawals this year will not be included in this number. The annual contribution limit for 2021 is 6000. Or you can get your balance by phoning CRAs Tax Information Phone Service.

The TFSA account is relatively new and often referred to as a younger sibling to the RRSP. The TFSA contribution limits on the CRA account are not always accurate and sometimes newer residents will find that the amount listed seem to assume that they gained room as soon as they turned 18. Step 2 Login to your CRA online account. Look for the 2021 TFSA contribution room on January 1 2021.

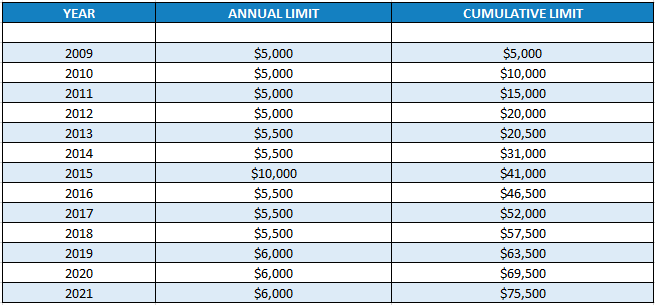

Total Contribution Room for 2009-2021. TFSA contribution room accumulates each year either beginning in 2009 or the year the individual turned 18 and is a resident of Canada for tax purposes. Banks credit unions etc are required to electronically submit a TFSA record to CRA for each individual who has a TFSA. Here is how you can check your TFSA Limit.

So if you were 18 years of age or older in 2009 you can deposit up to 75500 assuming you havent made any deposits. Step 1 If you havent already register for your CRA online account. If you turned 18 before or during 2009 you could contribute the max of 75500 as of 2021. You can see your TFSA balance as of January 1 of the current year by logging in to your online My Account on the CRA website.

The choice of investing in your TFSA or RRSP first is still a debated question but what isnt up for debate is your contribution amount per year and how much you accumulate in contribution room. How to check your TFSA contribution room. Thanks to its limited contribution room growing the TFSA to a million dollars seems a bit far-fetched but its possible if you keep the right stocks for the right amount of time in your TFSA. Because this information is delayed and sent once a year your TFSA contribution number may not be correct.

For 2009-2021 the total available contribution room for a TFSA is 75500. TFSA contribution room calculator. Canada Revenue Agency tracks your contribution room. Step 5- Using a calculator subtract all your TFSA.

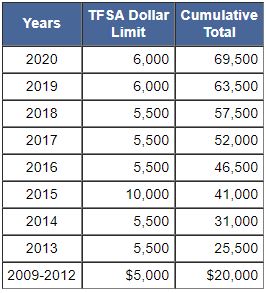

The annual TFSA dollar limit for the years 2013 and 2014 was 5500. Step 3 Scroll down to the bottom of your homepage. Quickly put login to your CRA account and scroll down to the bottom and check the amount next to TFSA. The annual TFSA dollar limit for the year 2015 was 10000.

As a reminder a TFSA allows any Canadian over the age of 18 to save or invest money in a tax-free account. The Canada Revenue Agency CRA tracks your contribution room. You can see your TFSA balance as of January 1 of the current year by logging in to your online My Account on the CRA website. Your contribution room determines the maximum amount that you can contribute to your TFSA.

The annual TFSA dollar limit for the years 2009 to 2012 was 5000. You can see your TFSA balance as of January 1 of the current year by logging in to your online My Account on the CRA website. A consistent growth stock. Based on what happened to some Questrade customers it might be worth checking your TFSA contribution room once in a while in case any mistakes have been made.

The CRA claims that the annual dollar limit for new contribution room in the TFSA is indexed for inflation. Another Financial Geek article How Can I Check my TFSA Limit gives a step by step breakdown on how to easily check your current TFSA contribution room. Step 4 Look at the amount assigned to your TFSA Contribution Room. If you turned 18 after 2009 its best to use the TFSA room calculator above to figure out how much total you can contribute as of 2020 as the calculations can get a bit tricky.

Unfortunately financial institutions are only required to report your TFSA contributions to the tax department at the end of December each year. Contributions to your TFSA. 2 hours agoWhile the contribution limit for 2021 is 6000 TFSA room is cumulative. You can check the details of what they are using by phoning the CRA at 1 800 959 8281 or by going online using the My Account service.

Or you can get your balance by phoning CRAs Tax Information Phone Service. Your maximum contribution room depends on when you were born. This value is your most accurate contribution room since the date. Note that investment income earned in your TFSA and changes in the value of your investments do not affect your TFSA contribution room for current or future years.

How to check your TFSA contribution room. Or you can get your balance by phoning CRAs Tax Information Phone Service. The TFSA contribution limits starts accumulating once you turn 18 unlike RRSP where you need to have income. How to use the Calculator.

You will accumulate TFSA contribution room for each year even if you do not file an Income Tax and Benefit Return or open a TFSA. Or you can get your balance by phoning CRAs Tax Information Phone Service. The annual TFSA dollar limit for the years 2013 and 2014 was 5500. The annual TFSA dollar limit for the years 2009 2010 2011 and 2012 was 5000.

Keep in mind that while theres no limit to the number of TFSAs an individual can open your contribution limit will remain the same. For that reason it is better to add up your own contribution room. How to check your TFSA contribution room. How Up to Date is the TFSA Contribution Room Information from the CRA.

And if 1 million is your goal in your TFSA there are three stocks that you might consider starting with. What you can check is how much contribution room was left at the start of the current year. You can see your TFSA balance as of January 1 of the current year by logging in to your CRA My Account. Latest tax return for your TFSA contribution room.

How To Calculate Your Tfsa Contribution Limit Money After Graduation

Tfsa Limit For 2021 Announced Fbc

Do You Know Your Tfsa Limit This Year Track It With This Template Howtoexcel Net

Tfsa Contribution Room How To Really Maximize Your Tfsa

How Do You Find Out Your Tfsa Contribution Room

Do You Know Your Tfsa Limit This Year Track It With This Template Howtoexcel Net

Posting Komentar untuk "how to check tfsa contribution room"